- (+91) 93811 85407

- info@remitrise.com

Madhapur, Hyderabad, India

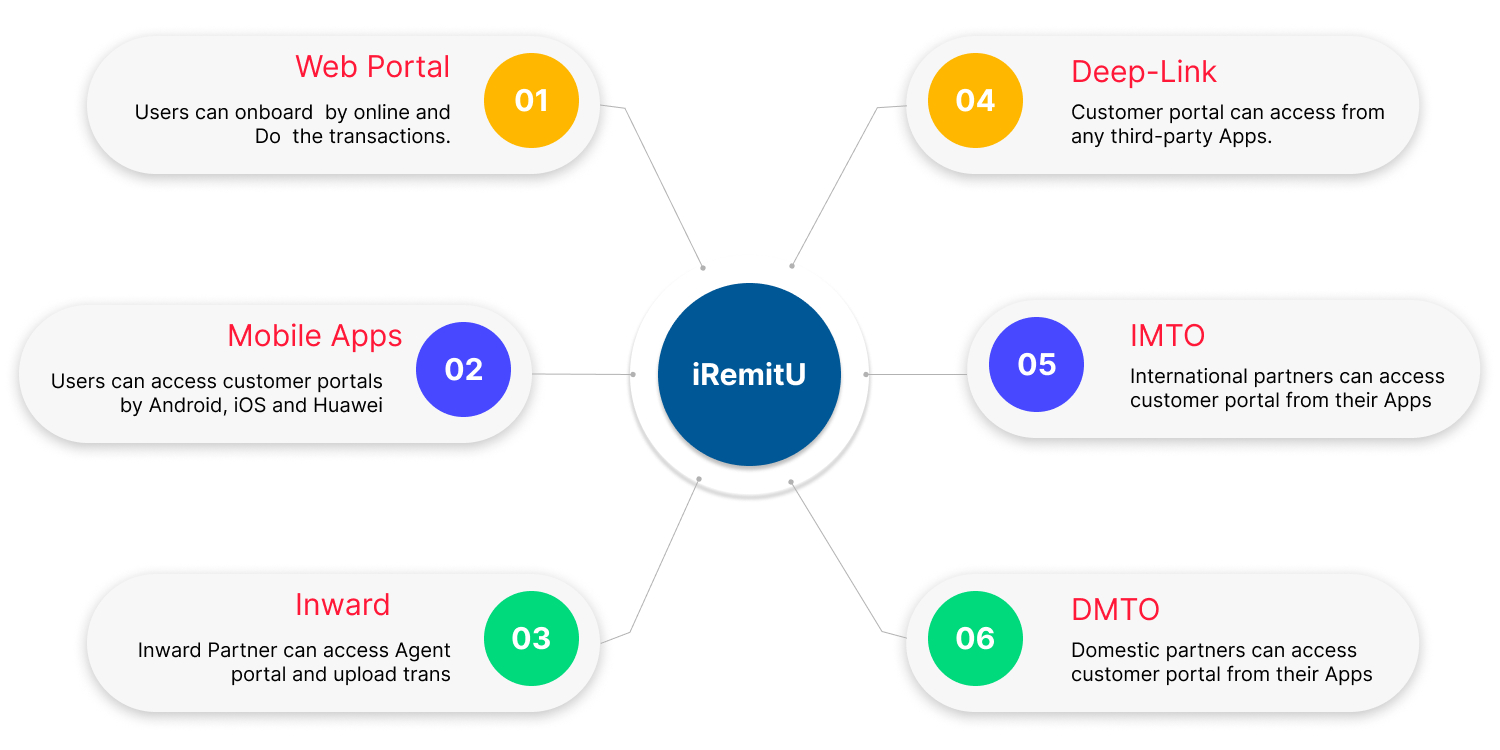

Multiple Channels

The iRemitU platform from RemitRise supports business growth across multiple channels, enhancing efficiency, customer experience, and operational control. The platform's comprehensive suite of portals and mobile apps streamline the remittance process by providing tailored interfaces for customers, administrators, and agents. It integrates various channels such as customer portals, branch services, agent networks, international money transfer operators (IMTOs), domestic money transfer operators (DMTOs), digital wallets, and inward remittance services. This multi-channel approach ensures seamless transactions, real-time monitoring, robust security, and extensive customization to meet diverse business needs, driving growth and improving service delivery.

Customer Portal

The Customer Portal provides a user-friendly interface for customers to manage their transactions, track payments, and access support services. It enhances customer experience by offering real-time transaction updates, secure payment options, and comprehensive transaction histories. Customizable features allow businesses to tailor the portal to their specific branding and service requirements, improving customer satisfaction and retention. By streamlining the remittance process, the Customer Portal reduces operational overhead and enables customers to conduct transactions at their convenience, fostering loyalty and repeat business.

Branch

Branch services offer a physical presence for customers who prefer face-to-face interactions. The iRemitU platform supports branch operations by providing tools for transaction processing, customer service, and administrative management. Branch staff can use the platform to efficiently handle customer inquiries, process remittances, and ensure compliance with regulatory requirements. The integration of branch services with digital channels ensures consistency and accuracy across all customer touchpoints, enhancing trust and reliability. By leveraging branch services, businesses can cater to a wider customer base, including those less comfortable with digital transactions.

Agent

Agent networks expand the reach of remittance services by enabling agents to facilitate transactions in various locations. The Agent Portal equips agents with the necessary tools to process remittances, manage customer interactions, and provide personalized services. Agents can access real-time transaction data, customer information, and support resources, ensuring efficient and accurate service delivery. The flexibility of the Agent Portal allows businesses to quickly scale their operations by adding new agents as needed. This channel helps businesses penetrate new markets and reach underserved populations, driving growth and increasing market share.

IMTO (International Money Transfer Operator)

IMTO integration allows businesses to offer cross-border remittance services through established international networks. The iRemitU platform supports seamless integration with multiple IMTOs, enabling businesses to provide competitive exchange rates and low fees for international transactions. This integration ensures compliance with global regulatory standards and enhances transaction security. By partnering with IMTOs, businesses can expand their service offerings, attract a global customer base, and increase revenue streams. The ability to facilitate international remittances positions businesses as reliable and comprehensive financial service providers.

DMTO (Domestic Money Transfer Operator)

DMTO integration enables businesses to offer domestic money transfer services, catering to customers who need to send funds within the same country. The iRemitU platform supports integration with various DMTOs, providing quick and secure domestic transfers. This channel helps businesses capture a significant share of the domestic remittance market by offering convenient and cost-effective solutions. By leveraging DMTO partnerships, businesses can enhance their service portfolio, meet diverse customer needs, and drive growth within the domestic market.

Wallet

Digital wallet integration provides customers with a convenient and secure way to store and transfer funds. The iRemitU platform supports various digital wallets, enabling customers to perform transactions directly from their mobile devices. Wallet integration enhances transaction speed, reduces reliance on traditional banking infrastructure, and offers additional features such as loyalty programs and instant payments. By incorporating digital wallets, businesses can attract tech-savvy customers, streamline payment processes, and reduce transaction costs. This channel supports the growing trend towards digital payments, positioning businesses for future growth.

Inwards

Inward remittance services enable businesses to facilitate the receipt of funds from international senders. The iRemitU platform supports the processing of inward remittances by providing secure and efficient transaction handling. Customers receiving funds can benefit from competitive exchange rates, low fees, and quick access to their money. By offering inward remittance services, businesses can tap into the substantial market of remittance receivers, increasing their customer base and revenue. This channel enhances customer satisfaction by ensuring reliable and timely fund delivery, fostering trust and repeat usage.