- (+91) 93811 85407

- info@remitrise.com

-

Madhapur, Hyderabad, India

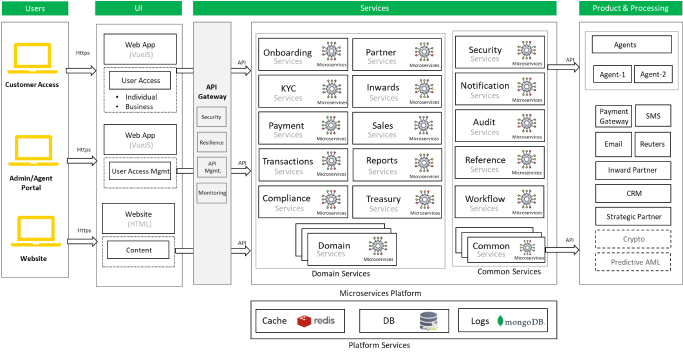

Microservices Architecture on iRemitU Suite

Microservices architecture breaks down the remittance platform into independently deployable services, each handling a specific function such as transaction processing, compliance, AML, and customer management. This allows for modular development, quicker updates, and easier scaling. Each service can be developed using the best-suited technology, improving efficiency and innovation. Fault isolation is enhanced, meaning issues in one service do not affect the entire system.

Microservices Architecture’s Remittance Suite Vs Legacy System’s Remittance Platform

| # | Name |

Microservices Architecture in International Remittance Platforms |

Legacy Remittance Platforms |

|---|---|---|---|

| 1 |

ScalabilityServices can be scaled independently based on demand. |

||

| 2 |

FlexibilityDifferent technologies can be used for different services. |

||

| 3 |

Fault IsolationFailures in one service do not bring down the entire system. |

||

| 4 |

Rapid DeploymentSmaller, independent services allow for faster and more frequent updates. |

||

| 5 |

Improved CollaborationTeams can work on different services simultaneously, increasing development speed. |

||

| 6 |

Technological StagnationEasy to adopting new technologies for specific functionalities. |

||

| 7 |

Business ComplexityComplexities of business logic of each functionalities can manage easily. |

Why Microservices in Remittance Applications?

Modularity and Specialization:

Microservice architecture Breaks down a remittance application into small, independent services, each handling a specific aspect of the application's functionality such as

-

User Management Service: Handles user registrations, logins, and profile management.

-

Transaction Processing Service: Manages the initiation, tracking, and completion of fund transfers.

-

Currency Conversion Service: Calculates exchange rates and converts currencies.

-

Compliance Service: Ensures adherence to regulatory requirements such as AML (Anti-Money Laundering) and KYC (Know Your Customer).

-

Notification Service: Sends notifications to users about transaction statuses and other relevant updates

Compliance and Security:

Regulatory requirements like AML and KYC are critical in remittance applications. Microservices allow for specialized compliance services that can be updated independently to meet evolving regulations.

Independent Scalability:

Remittance applications need to handle high transaction volumes, especially during peak times. Microservices enable scaling individual components based on demand.

Flexibility & Agility:

The financial technology landscape is rapidly changing. Microservices provide the agility to incorporate new features, integrations, and technologies without overhauling the entire system.

Reliability:

Remittance services need high availability. Microservices offer fault isolation, ensuring that a failure in one service doesn’t disrupt the entire application.

Performance:

Different services can be optimized independently for performance, improving the overall responsiveness and efficiency of the application.

Resilience and Fault Isolation:

If one microservice fails, it doesn’t bring down the entire application. This isolation improves the overall reliability and availability of the application.

Technology Diversity:

Different microservices can use different technologies best suited for their specific needs, allowing for greater flexibility and optimization.

What type of Database structure needed? Is Shared DB or Multiple databases?

The type of database structure (shared vs. multiple) should align closely with the specific business requirements and the architectural goals of the business needs. In many cases, a hybrid approach or a database-per-service strategy can provide the flexibility and performance needed while managing complexity effectively. Always consider and making decision based on Partner’s business requirement.

Microservice Architecture:

Empowering iRemitU for Modern Challenges

At iRemitU, we recognize the challenges posed by legacy systems, particularly during peak hours when stress and downtimes can impact business operations and customer satisfaction. To address these issues effectively, we advocate for a shift towards a more robust system architecture tailored to meet the demands of esteemed organizations like yours through exceptional engineering.

Central to our approach is the adoption of Microservices architecture. This innovative framework transforms traditional, monolithic systems into a collection of smaller, independent services. Each service operates through well-defined APIs, enabling individual scaling and updates without compromising the integrity of the entire system.

This modular setup significantly enhances system reliability during critical times and supports multidimensional scalability. It seamlessly accommodates an increase in users, transactions, and the integration of new functionalities, ensuring that iRemitU remains adaptable and responsive to industry demands.